Saving Tax using Business Safety Mutual Relief System

This article is contributed by WINgs llc.

Have you ever heard of the Business Safety Mutual Relief System? This is a type of Small Business Mutual Aid offered by SME(Organization for Small & Medium Enterprises and Regional Innovation, Japan) for Companies in Japan. The purpose of this mutual aid is to offer loans which are available when a business partner goes bankrupt and accounts receivable and other receivables become difficult to collect.

Also known as Mutual Aid for Bankruptcy Prevention, since its inception in 1978, approximately 590,000 companies and businesses have enrolled in the system as of March 2022. This mutual aid is popular for both Individuals (with sales) and Japanese companies as an effective tax-reduction strategy, and here is why.

All premiums are fully expensed (deductible)

When joining the Business Safety Mutual Relief System, you are required to pay a monthly premium. Premiums can be set freely within the range of 5,000 yen to 200,000 yen (in units of 5,000 yen).

The entire amount of this premium becomes an expense (deductible expense). In the case of life insurance for example, generally only 1/2 of the premium is expensed, so it can be said that the tax reduction benefit of the Mutual Aid for Bankruptcy Prevention is more significant.

If you wish to change your premiums, you may do so by submitting an application form. However, reductions in premiums are not allowed unless the size of your business has shrunk or your business conditions have deteriorated significantly. In addition, premiums can be accumulated until the total amount of premiums reaches 8 million yen.

When premiums are paid for over 40 months, you will receive 100% of your savings back

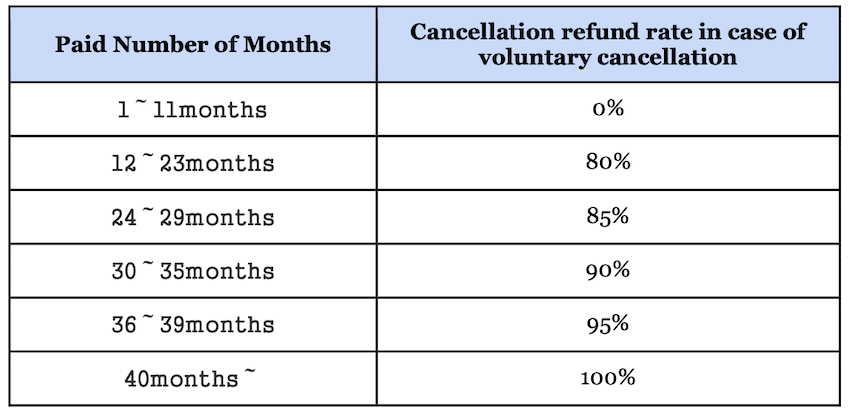

Contracts may be terminated at any time. When you terminate the contract, you will receive back the premiums you have accumulated as a cancellation refund, but the amount you will receive back depends on the number of months you have paid for the premiums.

This means that if you have paid premiums for more than 40 months, you will receive the full amount of the premiums you have paid so far. It is important to note that this cancellation refund is income (gain).

Although you might have saved taxes for a certain period, it would be meaningless if you end up receiving the cancellation refund as income since it will result in an increase in taxes. Therefore, it is advisable to aim for the timing of cancellation when there are expenses such as retirement benefits or major repairs (which are deductible at the time of expenditure).

Alternatively, you can cancel it when you have a large deficit. The funds would help when you are in deficit and will make your financial statements look better.

In the event of a client's bankruptcy, a loan of 10 times the amount of the reserve is available.

The main purpose of the Business Safety Mutual Relief System is to prevent a chain reaction of bankruptcies in the event of a business partner's bankruptcy. Therefore, if a company's business partner goes bankrupt, it is possible to receive a loan through the system. (Must be legally bankrupt, otherwise you may not be able to receive a Mutual Aid loan).

The maximum loan amount is limited to 10 times the total amount of premiums accumulated to date (but within the amount of uncollectible receivables due to business partner's bankruptcy). Mutual aid funds can be borrowed without collateral or guarantees.

Although the loan is interest-free, 1/10 of the total amount of premiums is deducted from the total amount of premiums when the mutual aid loan is received, so this 1/10 can be said to be the actual interest. The payback period is 5 to 7 years, depending on the loan amount.

Loans are available even if the business partner is not in bankruptcy

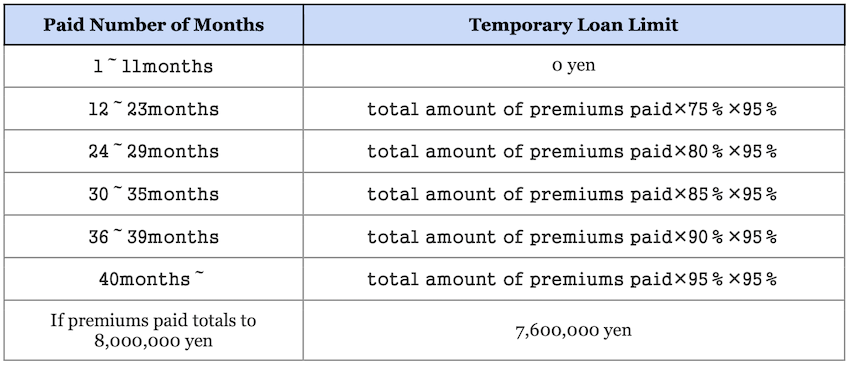

Those who have enrolled in the Business Safety Mutual Relief System can receive a loan under the system of temporary loans even if their business partner has not gone bankrupt. The maximum amount of loan is as follows, depending on the number of months of premium payment.

Temporary loans can also be borrowed without collateral or guarantees, but interest will accrue. In addition, the repayment period is one year.

Difference between Small-Scale Enterprise Mutual Aid and Business Safety Mutual Relief System

The policyholder of the Small-Scale Enterprise Mutual Aid is an individual, while the policyholder of the Business Safety Mutual Relief System is a corporation (however, if you are a sole proprietor, the policyholder is an individual). Therefore, if you join the Small-Scale Enterprise Mutual Aid, you will pay the premiums as an individual, which will result in income tax savings.

On the other hand, if you join the Business Safety Mutual Relief System, you will pay the premiums as a corporation, which will save corporate tax.

In addition, the mutual aid (cancellation refund) received upon withdrawal (cancellation) from the Small-scale Enterprise Mutual Aid will be personal income (retirement income or miscellaneous income/temporary income), while the cancellation refund received upon cancellation of the Business Safety Mutual Relief System will be the corporation's income. Since each has different usages, it is important to properly distinguish between the two.

Qualifications for Enrollment in the Business Safety Mutual Relief System

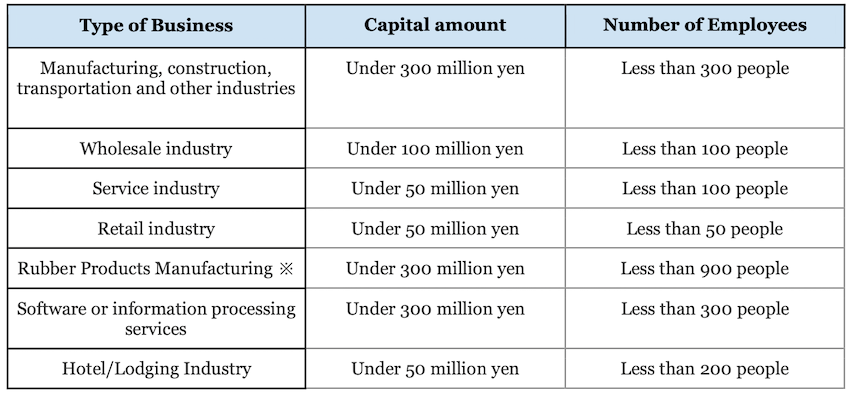

The Business Safety Mutual Relief System is available to corporations or sole proprietors who have been in business for at least one year. Please note that if you have been in business for less than one year, you cannot join the Business Safety Mutual Relief System.

In addition, depending on the type of business, corporations or sole proprietors that meet the following requirements may join the Business Safety Mutual Relief System.

※Manufacture of tubes, tires for motor vehicles and/or aircraft, and industrial belts are excluded.

This is just an example of a method to help reduce tax payments, and there are more WINgs can share. The office is located by Shinjuku Station, and WINgs aims to support, lead, and run along with business owners with small-medium sized companies to help expand their dreams and visions. They specialize in back office services which includes accounting, business startups, HR, and more. Other than back office services, WINgs also offers financial advisory to help grow your company such as tax planning and financial strategies.

Visit WINgs website for more details, and let’s get in touch! Please contact through the inquiry form on the website.

WINgs llc.

Location: Rm410, Shinagawa Station Bldg. Shinjuku, 1-3-3 Nishishinjuku, Shinjuku, Tokyo

https://wings.hp.peraichi.com/