Navigating Lump-Sum Withdrawal Payments for Pension: A Guide for Foreigners Departing Japan

This article is contributed by LOOK UP ACCOUNTING.

Individuals who have been enrolled in the Employees’ Pension or the National Pension (and meet certain eligibility requirements) can be paid back for their contributions, even after departing Japan. This is called the Lump-Sum Withdrawal Payment.

This guide (based on information from the Japan Pension Service1) aims to provide an overview of the eligibility criteria, application process, considerations, and remuneration rates for those seeking to claim their Pension contributions from Japan. If you’re an expatriate, sole proprietor, employee, or pension contributor planning to depart from Japan, this guide is for you.

Eligibility Criteria

To be eligible for a Lump-Sum Withdrawal Payment, individuals must meet the following requirements:

1. Non-Japanese nationality

You do not have Japanese nationality.

2. Contribution-paid period

You have paid National Pension or Employees’ Pension Insurance for six months or more (i.e. contribution-paid period is six months or more).

3. No address in Japan

You do not have an address in Japan at the time of the claim (i.e. you have completed moving-out procedures, see below for details).

4. No eligibility for pension

You have never been eligible to receive a pension, including disability allowance.

Notes on Eligibility

Old-age Pension

Applicants who have paid a pension in Japan for 10 years (120 months) or more cannot claim the Lump-sum Withdrawal Payment because they can receive the Japanese Old-age Pension in the future. Complementary periods and enrollment in partner countries' pension systems can also affect eligibility.

Income tax considerations

Income tax on Lump-Sum Withdrawal Payments for Employees' Pension Insurance is withheld at the rate of 20.42%, however, a tax withholding refund is possible by submitting the appropriate tax return. To request a refund, claimants must submit the "Notification of Tax Agent for Income Tax/Consumption Tax" 2 to the tax office linked to their final address or residence in Japan. Income tax is not withheld at the source in the case of payment for the National Pension.

Application Process

The process involves submitting the Lump-sum Withdrawal Payment Claim Form3 (National Pension/Employees’ Pension Insurance) to the Japan Pension Service either in person or by mail.

1. Copy of passport

Including the page verifying name, date of birth, nationality, signature, and status of residence.

2. Documents verifying no address in Japan

Such as a deleted residence record.

3. Bank account information

Documents verifying the applicant’s bank name, branch name, branch location, bank account number, and the bank account holder’s name - showing that the bank account holder is the applicant.

4. Basic pension number clarification

Documents such as the Basic Pension Number Notice or Pension Handbook.

Notes on Submitting a Claim

Timing of Claim

It's important to note that a claim for the Lump-Sum Withdrawal Payment must be submitted within two years from the date the individual no longer has an address in Japan, or if they lost their qualification for the National Pension or the Employee's pension.

To claim before departure

Applicants must submit a Moving-out Notification and their (planned) deletion date of residence record before making a claim to the Japan Pension Service.

In Case of Death

In the unfortunate case that the claimant dies before receiving the Lump-Sum Withdrawal Payment, eligible third-degree family members may receive the payment, provided the claimant submitted the Claim Form before their death.

How is the Lump-Sum Payment Calculated?

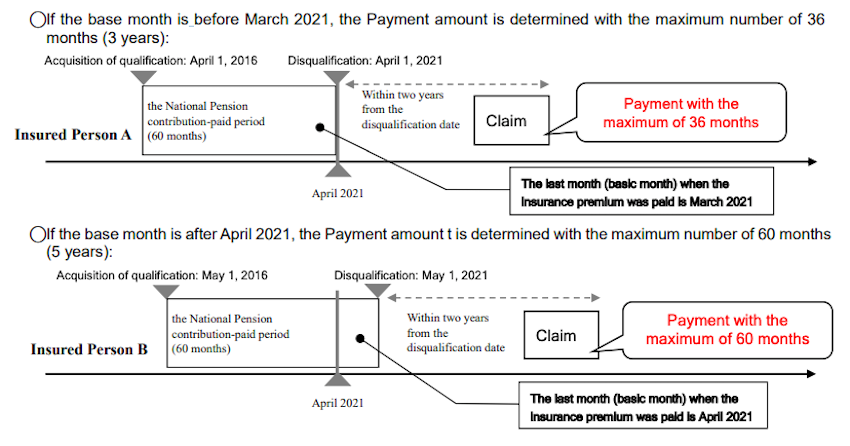

The calculation of remuneration or payment amount differs based on the applicants’ pension status in Japan; either National Pension or Employee Pension. In both cases, from April 2021, the maximum number of months used in the calculation of the Payment Amount has been raised from 36 months (3 years) to 60 months (5 years).

For those insured in the National Pension

If you have been contributing to the National Pension, for example, as a sole proprietor, the remuneration amount is based on the following calculation.

The calculation method

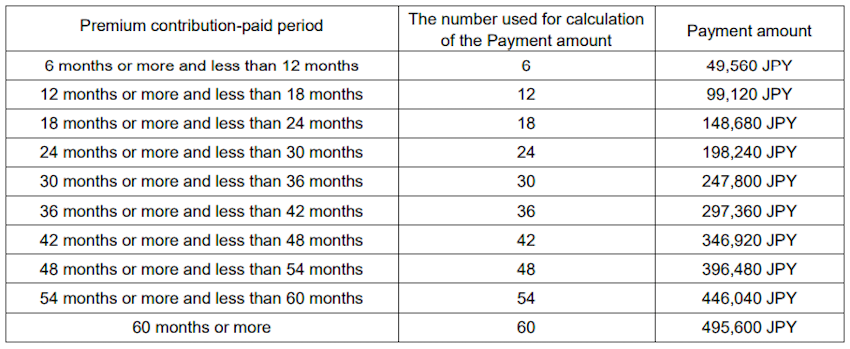

Lump-sum Withdrawal Payment Amount = National pension premium amount for the year that includes the base month when the insurance premium contribution was paid last time × 1/2 × Number used for calculation of the Payment Amount

For example: If you paid the National Pension for 60 months, the remuneration amount is JPY 495,600.

National Pension payment amount calculated with a base month before March 2021 or after April 2021

Image from p.7 "Lump-sum Withdrawal Payment Claim Form" by Japan Pension Service.

Payment amount when the base month is between April 2023 and March 2024

Table from p. 8 "Lump-sum Withdrawal Payment Claim Form" by Japan Pension Service.

*Depending on the National Pension premium amount, payments before March 2023 vary.

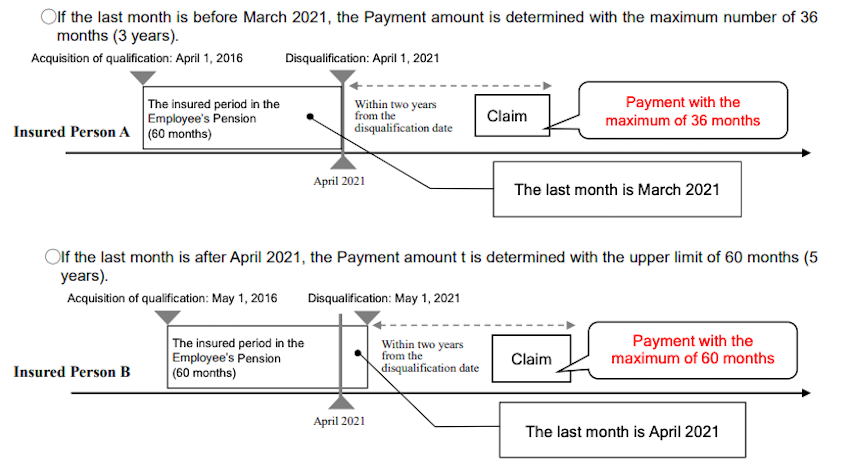

For those insured in the Employees’ Pension

If you have been contributing to the Employees' Pension, for example, as a company employee, the remuneration amount will vary based on your monthly salary.

The calculation method

Lump-sum Withdrawal Payment Amount = Average standard remuneration of the insured period × Payment rate ((Insurance rate × 1/2) × Number according to the number of months of the insured period)

For example: If your average monthly salary is 400,000 JPY for 5 years, the remuneration amount is:

JPY 400,000 x 5.5% x 1/2 x 60 month = JPY 660,000

Employee Pension payment amount calculated with a base month before March 2021 or after April 2021

Excerpt from p. 11 "Lump-sum Withdrawal Payment Claim Form" by Japan Pension Service.

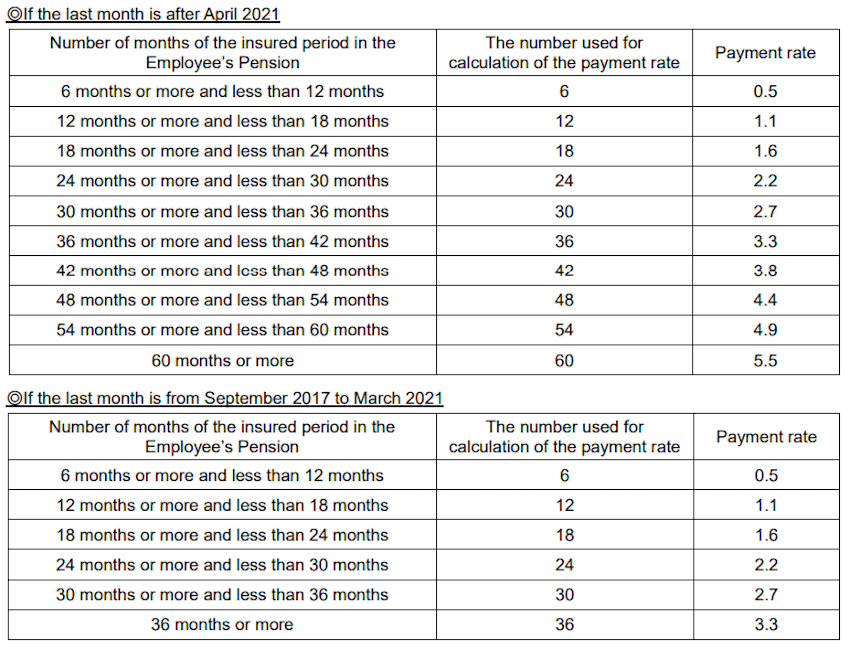

Payment rate if last month is after April 2021 or between September 2017 to March 2021

Table from p. 12 "Lump-sum Withdrawal Payment Claim Form" by Japan Pension Service.

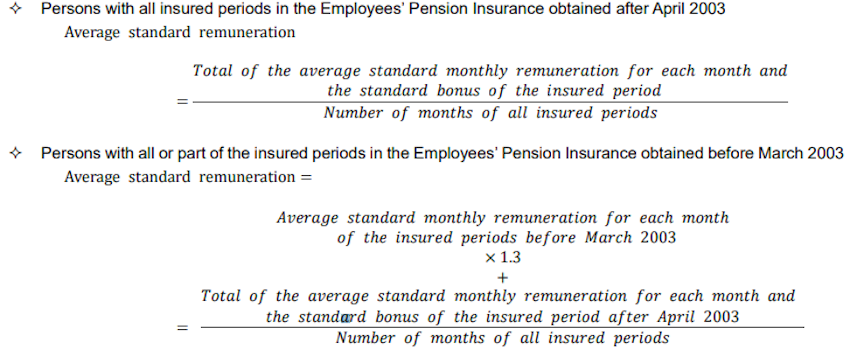

Average Standard Remuneration

The average standard remuneration is based on the following equations:

Excerpt from p. 12 "Lump-sum Withdrawal Payment Claim Form" by Japan Pension Service.

In Summary

Individuals who have made contributions to Japan’s National or Employee Pension and meet the eligibility requirements can claim their Lump-Sum Withdrawal Payment before or after leaving Japan. However, applicants must take care to submit the required form and documents to the Japan Pension Service either in person or by mail within the required period. The remuneration amount will differ based on factors such as contribution-paid period and pension insurance status.

For any queries or requests for tax agency services such as claiming a Lump-Sum Withdrawal Payment for Japan’s Pension, please contact the team at LOOK UP ACCOUNTING via this inquiry form.

LOOK UP ACCOUNTING is a firm that meets the business needs of our modern era. Combining professional expertise with digital technology, we offer Japanese and English accounting, tax, and HR management support services for individuals, startups, and small to midsize businesses. Our client base is multinational and varied across industries. We care about you and your business and use digital tools like Slack and Zoom to communicate efficiently with our partners.

References:

1) Lump-sum Withdrawal Payments Webpage (Japan Pension Service)

2) Notification and Applications for the National Tax Agency

3) Lump-sum Withdrawal Payment Claim Form (Japan Pension Service)