A Guide to Taxes in Japan for Freelancers - Part 1: What is the Japanese Tax Return?

This article is contributed by LOOK UP ACCOUNTING.

Navigating the complexities of tax returns as a freelancer or sole proprietor in Japan can be daunting, especially without a clear understanding of the processes involved. "A Guide to Taxes in Japan for Freelancers: Part 1 - What is the Japanese Tax Return?" is the first in a three-part series, which aims to clarify what the tax return is, who needs to file it, and the deadline for submission.

What is the final tax return?

→ Ref: NTA 1- 2 What is the final return? 1- 3 Taxpayers and the scope of taxable income

→ Ref: NTA No.12011 Final tax return

The tax return or final tax return (kakutei shinkoku 確定申告) is an annual process for freelancers or sole proprietors (kojin jigyo nushi 個人事業主) in Japan. Since sole proprietors typically don't have taxes automatically withheld from their income, they need to self-assess and report their income tax themselves. In comparison, companies withhold tax from their employees and calculate taxable income on their behalf through year-end adjustments.

Essentially, sole proprietors must report their income from the previous year (January 1st to December 31st) to the tax authorities between February 16th and March 15th. As part of this, you’ll need to calculate how much tax you owe (or are owed), and you’ll receive a refund if you’re eligible. This process settles the difference if there are taxes withheld at the source of payment.

| If you... | Your tax return means... |

| Paid more tax than you owe | Receiving a tax refund |

| Paid less tax than you owe | Paying the difference |

Why do we need to submit a tax return?

Essentially, submitting a tax return is playing your part as a resident and sole proprietor in Japan to ensure you’re contributing the right tax amount to the government. It's also an opportunity to claim deductions for costs relating to your business such as work equipment, electricity and wifi when working from home, and transport costs. This can potentially reduce your tax liability.

For additional context, the national tax office can’t calculate everyone’s income tax, so sole proprietors need to calculate and report it themselves, or ask a tax accountant to do it on their behalf.

What happens if you don't file a tax return?

→ Ref: NTA No.14001 Overview of delinquent tax and additional tax

While completing your tax return is a requirement, the consequences for not filing your taxes on time can vary. If you’ve paid more tax than you actually owe, there are no penalties for not filing a tax return (as you’ve essentially paid the tax office more money!) However, you can claim a refund on overpayments (from January 1st in the following year up to five years later). If you owe tax and filed after the due date, you’ll likely be charged additional tax or ‘delinquent tax’.

|

The calculation is as follows: Principal amount of tax × |

What is the difference between tax returns and end-of-year adjustments?

→ Ref: No.12018 Wage earners who must file a final tax return

Both tax returns and year-end adjustments are processes for calculating, declaring, and paying taxes owed to the government. They differ in terms of who they apply to, when they need to be filed, and the types of deductions available.

Essentially, end-of-year adjustments (nenmatsu chosei 年末調整) involve calculating the amount of income tax withheld from salaries and need to be filed by employers on behalf of their employees. On the other hand, tax returns are generally completed individually by freelancers and sole proprietors (note, some company employees and executives may need to file a tax return too).

What is income tax?

→ Ref: 財務省 Learn about "Income Tax”

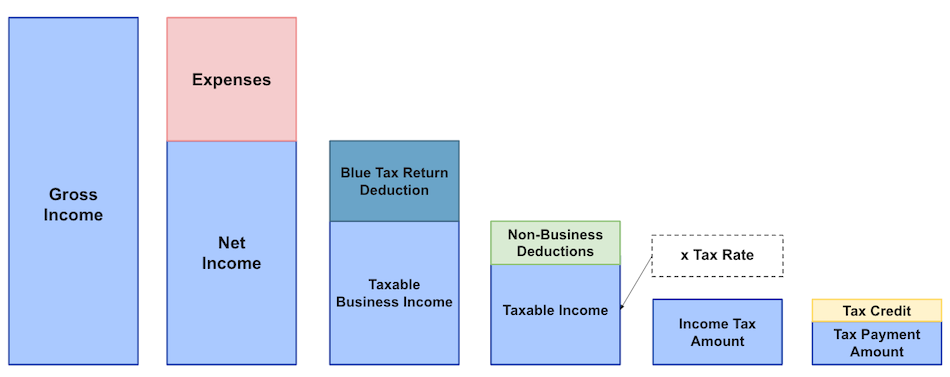

Individual Income Tax is a tax imposed on personal income (including salary, and business income) earned in a year starting from January 1 through December 31. It’s calculated as follows:

1. Gross Income − Expenses, etc. = Net Income (A)

2. Net Income (A) − Deductions = Taxable Income (B)

3. Taxable Income (B) × Tax Rate = Income Tax Amount (The tax rate gradually rises along with the increased taxable income (B))

4. Income Tax Amount - Tax Credit Amount = Tax Payment Amount

For example:

| Gross income (6,000,000 yen) - Expenses (2,000,000 yen) = Net Income (4,000,000 yen) |

| Net Income (4,000,000 yen) - Blue Tax Return Deduction (650,000 yen) = Taxable Business Income (3,350,000 yen) |

| Taxable Business Income (3,350,000 yen) - Non-Business Deductions (750,000 yen) = Taxable Income (2,600,000 yen) |

| Taxable Income (2,600,000 yen) x Tax Rate (10%) = Income Tax Amount (260,000 yen) |

| Income Tax Amount (260,000 yen) - Tax Credit Amount (97,500 yen) = Tax Payment Amount (162,500 yen) |

* Non-business deductions include various deductions such as the Basic deduction of 480,000 yen, Social insurance deduction, Furusato nozei deduction, etc.

Image: LOOK UP ACCOUNTING

When do I file a tax return?

You will need to submit your tax return for income earned in the past year from February 16th to March 15th.

For example, for income earned between Jan. 1st and Dec 31st, 2024, that is, your 2024 tax return, you’ll need to submit it from February 16th to March 15th, 2025.

You can do this by submitting the forms directly at your registered tax office or online via e-Tax. If you ask a tax accountant to complete it on your behalf, we recommend reaching out at least a month in advance of this period.

Who needs to file a tax return?

→ Ref: pg. 8 Ministry of Justice

In principle, you will need to submit a tax return if:

・Your annual income as a freelancer or sole proprietor is 480,000 yen or more

・You are a company employee and earn 200,000 yen or more business income in a side job*

*Note: Even if your income from a side job is less than 200,000 yen, it may be better to file a tax return. This applies to cases where you might be paying too much income tax. If you are filing a final tax return to receive a mortgage deduction or medical expense deduction, you also have to declare your income from a side job, even if it is less than 200,000 yen.

Who is exempt from the tax return?

→ Ref: 出典:国税庁「確定申告が必要な方」

You may be exempt from the tax return if you fall into any of the following categories:

・Your business income as a sole proprietor is 480,000 yen or less

・You are an employee with a salary income of 20 million yen or less and your annual income from side jobs, etc., is 200,000 yen or less

・You receive 4 million yen or less in National Pension and your annual income from a side job is 200,000 yen or less

We’ll follow up in Part 2 of the series to explain more about the tax return in detail.

Disclaimer

This article is intended only as a basic guide to taxes in Japan. We make every effort to ensure that the information presented here is accurate and up to date. However, all details are subject to change at any time. LOOK UP Corp. cannot guarantee the accuracy, currency, or completeness of any of the material and information in this article and accepts no responsibility or liability arising from or connected to the material provided above.

LOOK UP ACCOUNTING

LOOK UP ACCOUNTING is a firm that meets the business needs of our modern era. Combining professional expertise with digital technology, we offer Japanese and English accounting, tax, and HR management support services for individuals, startups, and small to midsize businesses. Our client base is multinational and varied across industries. We care about you and your business and use digital tools like Slack and Zoom to communicate efficiently with our partners.